|  | ||||||||||||||||||||

|  |  |  | ||||||||||||||||||

|  |  | |||||||||||||||||||

Metrotecs provides website design and website hosting services for small to medium sized businesses. Our website design packages afford you the following: | |||||||||||||||||||||

NEED A WEBSITE FAST AND AFFORDABLE?...WELL I'VE GOT JUST THE RIGHT COMPANYFOR YOU!!!

Wednesday, March 23, 2011

The Great Depression; How can we learn from the past?

Thursday, February 10, 2011

Start of the Great Depression

See also: Timeline of the Great Depression

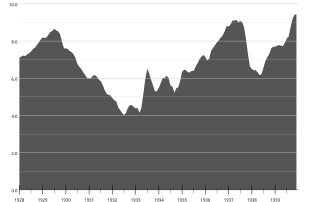

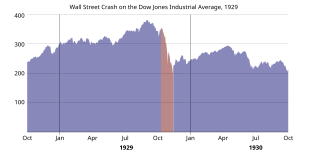

Dow Jones Industrial, 1928-1930

By mid-1930, interest rates had dropped to low levels. But expected deflation and the continuing reluctance of people to borrow meant that consumer spending and investment were depressed.[13] By May 1930, automobile sales had declined to below the levels of 1928. Prices in general began to decline, although wages held steady in 1930; but then a deflationary spiral started in 1931. Conditions were worse in farming areas, where commodity prices plunged, and in mining and logging areas, where unemployment was high and there were few other jobs. The decline in the US economy was the factor that pulled down most other countries at first, then internal weaknesses or strengths in each country made conditions worse or better. Frantic attempts to shore up the economies of individual nations through protectionist policies, such as the 1930 U.S. Smoot–Hawley Tariff Act and retaliatory tariffs in other countries, exacerbated the collapse in global trade. By late 1930, a steady decline in the world economy had set, which did not reach bottom until 1933.

Economic indicators

Change in economic indicators 1929-32[14]| USA | Britain | France | Germany | |

| Industrial production | -46% | -23 | -24 | -41 |

| Wholesale prices | -32% | -33 | -34 | -29 |

| Foreign trade | -70% | -60 | -54 | -61 |

| Unemployment | +607% | +129 | +214 | +232 |

Causes

Main article: Causes of the Great Depression

There were multiple causes for the first downturn in 1929. These include the structural weaknesses and specific events that turned it into a major depression and the manner in which the downturn spread from country to country. In relation to the 1929 downturn, historians emphasize structural factors like massive bank failures and the stock market crash. In contrast, economists (such as Barry Eichengreen, Milton Friedman and Peter Temin) point to monetary factors such as actions by the US Federal Reserve that contracted the money supply, as well as Britain's decision to return to the Gold Standard at pre-World War I parities (US$4.86:£1).Recessions and business cycles are thought to be a normal part of living in a world of inexact balances between supply and demand. What turns a normal recession or 'ordinary' business cycle into an actual depression is a subject of much debate and concern. Scholars have not agreed on the exact causes and their relative importance. Moreover, the search for causes is closely connected to the issue of avoiding future depressions.

Thus, the personal political and policy viewpoints of scholars greatly colors their analysis of historic events occurring eight decades ago. An even larger question is whether the Great Depression was primarily a failure on the part of free markets or, alternately, a failure of government efforts to regulate interest rates, curtail widespread bank failures, and control the money supply. Those who believe in a larger economic role for the state believe that it was primarily a failure of free markets, while those who believe in a smaller role for the state believe that it was primarily a failure of government that compounded the problem.

Current theories may be broadly classified into two main points of view and several heterodox points of view. First, there are demand-driven theories, most importantly Keynesian economics, but also including those who point to the breakdown of international trade, and Institutional economists who point to underconsumption and over-investment (causing an economic bubble), malfeasance by bankers and industrialists, or incompetence by government officials. The consensus among demand-driven theories is that a large-scale loss of confidence led to a sudden reduction in consumption and investment spending. Once panic and deflation set in, many people believed they could avoid further losses by keeping clear of the markets. Holding money became profitable as prices dropped lower and a given amount of money bought ever more goods, exacerbating the drop in demand.

Secondly, there are the monetarists, who believe that the Great Depression started as an ordinary recession, but that significant policy mistakes by monetary authorities (especially the Federal Reserve), caused a shrinking of the money supply which greatly exacerbated the economic situation, causing a recession to descend into the Great Depression. Related to this explanation are those who point to debt deflation causing those who borrow to owe ever more in real terms.

Lastly, there are various heterodox theories that downplay or reject the explanations of the Keynesians and monetarists. For example, some new classical macroeconomists have argued that various labor market policies imposed at the start caused the length and severity of the Great Depression. The Austrian school of economics focuses on the macroeconomic effects of money supply, and how central banking decisions can lead to over-investment (economic bubble). The Marxist critique of political economy emphasizes the tendency of capitalism to create unbalanced accumulations of wealth, leading to overaccumulations of capital and a repeating cycle of devaluations through economic crises.

Demand-driven

Keynesian

British economist John Maynard Keynes argued in General Theory of Employment Interest and Money that lower aggregate expenditures in the economy contributed to a massive decline in income and to employment that was well below the average. In such a situation, the economy reached equilibrium at low levels of economic activity and high unemployment. Keynes' basic idea was simple: to keep people fully employed, governments have to run deficits when the economy is slowing, as the private sector would not invest enough to keep production at the normal level and bring the economy out of recession. Keynesian economists called on governments during times of economic crisis to pick up the slack by increasing government spending and/or cutting taxes.As the Depression wore on, Franklin D. Roosevelt tried public works, farm subsidies, and other devices to restart the economy, but never completely gave up trying to balance the budget. According to the Keynesians, this improved the economy, but Roosevelt never spent enough to bring the economy out of recession until the start of World War II.[15]

Breakdown of international trade

Many economists have argued that the sharp decline in international trade after 1930 helped to worsen the depression, especially for countries significantly dependent on foreign trade. Most historians and economists partly blame the American Smoot-Hawley Tariff Act (enacted June 17, 1930) for worsening the depression by seriously reducing international trade and causing retaliatory tariffs in other countries. While foreign trade was a small part of overall economic activity in the U.S. and was concentrated in a few businesses like farming, it was a much larger factor in many other countries.[16] The average ad valorem rate of duties on dutiable imports for 1921–1925 was 25.9% but under the new tariff it jumped to 50% in 1931–1935.In dollar terms, American exports declined from about $5.2 billion in 1929 to $1.7 billion in 1933; but prices also fell, so the physical volume of exports only fell by half. Hardest hit were farm commodities such as wheat, cotton, tobacco, and lumber. According to this theory, the collapse of farm exports caused many American farmers to default on their loans, leading to the bank runs on small rural banks that characterized the early years of the Great Depression.

Debt deflation

Irving Fisher argued that the predominant factor leading to the Great Depression was over-indebtedness and deflation. Fisher tied loose credit to over-indebtedness, which fueled speculation and asset bubbles.[17] He then outlined 9 factors interacting with one another under conditions of debt and deflation to create the mechanics of boom to bust. The chain of events proceeded as follows:- Debt liquidation and distress selling

- Contraction of the money supply as bank loans are paid off

- A fall in the level of asset prices

- A still greater fall in the net worths of business, precipitating bankruptcies

- A fall in profits

- A reduction in output, in trade and in employment.

- Pessimism and loss of confidence

- Hoarding of money

- A fall in nominal interest rates and a rise in deflation adjusted interest rates.[17]

Bank failures snowballed as desperate bankers called in loans which the borrowers did not have time or money to repay. With future profits looking poor, capital investment and construction slowed or completely ceased. In the face of bad loans and worsening future prospects, the surviving banks became even more conservative in their lending.[19] Banks built up their capital reserves and made fewer loans, which intensified deflationary pressures. A vicious cycle developed and the downward spiral accelerated.

The liquidation of debt could not keep up with the fall of prices which it caused. The mass effect of the stampede to liquidate increased the value of each dollar owed, relative to the value of declining asset holdings. The very effort of individuals to lessen their burden of debt effectively increased it. Paradoxically, the more the debtors paid, the more they owed.[17] This self-aggravating process turned a 1930 recession into a 1933 great depression.

Macroeconomists including Ben Bernanke, the current chairman of the U.S. Federal Reserve Bank, have revived the debt-deflation view of the Great Depression originated by Fisher.[21][22]

Monetarist

Crowd at New York's American Union Bank during a bank run early in the Great Depression.

One reason why the Federal Reserve did not act to limit the decline of the money supply was regulation. At that time, the amount of credit the Federal Reserve could issue was limited by the Federal Reserve Act, which required 40% gold backing of Federal Reserve Notes issued. By the late 1920s, the Federal Reserve had almost hit the limit of allowable credit that could be backed by the gold in its possession. This credit was in the form of Federal Reserve demand notes. A "promise of gold" is not as good as "gold in the hand", particularly when they only had enough gold to cover 40% of the Federal Reserve Notes outstanding. During the bank panics a portion of those demand notes were redeemed for Federal Reserve gold. Since the Federal Reserve had hit its limit on allowable credit, any reduction in gold in its vaults had to be accompanied by a greater reduction in credit. On April 5, 1933, President Roosevelt signed Executive Order 6102 making the private ownership of gold certificates, coins and bullion illegal, reducing the pressure on Federal Reserve gold.[28]

Business Plans etc....Great Product & a great price,you can put a stamp on that!!!

Wednesday, February 9, 2011

TCD Elsmore Capital Group60 State Street

7th Floor

Boston, MA 02109-1800

ph: 508-718-7012

thomas@tcdbusinessplans.com

7th Floor

Boston, MA 02109-1800

ph: 508-718-7012

thomas

My Services

I have over (25) years experience in the business field and will give you solid business development suggestions.

Business Plan Types

Equity Plans

Investor Concept Plans $150.00 - The purpose of this plan is to display a concept to friends, partners, realtors, potential investment partners and others. This plan is for concept only and designed for that purpose and should not be used as a full business plan.

Investor Presentation Plans $500.00 - This style of plan is for equity based projects seeking up to $3M in capital or combined infusion.

Jumbo Investor Plans $1,500.00 - This plan is designed for projects seeking over $3M in capital from combined sources.

Institutional & Banking Plans

Small SBA Business Plans $250.00 - This type plan is designed for pursuance of a small SBA loan up to $200,000; for microloans, lines of credit, lease purposes, economic development loans and other smaller institutional presentations.

Larger Banking Business Plans $400.00 - This style of plan is designed for presentation to lending institutions when you are seeking up to $2,000,000 in loans for your business or project.

Corporate Business Plan $600.00 - This style of plan is for existing business or corporations that are seeking expansion monies, growth capital or just presenting new ideas to shareholders or staff.

Project Professional Plan $900.00 - The purpose of this plan is for larger projects seeking $2M to $6M in loans. The ideal project type for this type of plan would be a property development, energy project or hotel purchase.

For plans seeking to obtain $6M or more pricing will be developed after complete review of required plan complexity.

A business plan helps to communicate your ideas to others and provides the basis for a financial proposal. These days more and more lenders require one, not only as a requirement for a loan, but also as a mechanism to remain profitable. I will write a comprehensive business plan that will include all the information that lenders, investors, venture capitalist, and many others are looking for in a business plan.

Copyright 2010 TCD Elsmore Capital Group. All rights reserved.

Posted by

Global Info Group

at

10:46 AM

0

comments

Email This

BlogThis!

Share to X

Share to Facebook

Atlanta Urban League

Friday, January 28, 2011

Home ResourcesResource NavigatorPortalsEntrepreneur Businesss Mentor ProgramFAQs About Small BusinessI need a grant for my business. What is available??What is the difference between a for-profit business and a nonprofit organization?What does it mean to be WBE or MBE certified?How can I certify my business as Federal E.O.E. compliant?Resource Library Documents Calendar Get FundingDebt Funding ExplainedEquity Funding ExplainedFunding Sources NewsSBA announces ARC Loan ProgramThe Entrepreneur Center News Video About UsContact UsBecome a Resource PartnerSite Map

Upcoming Events

No events available.

Entrepreneurship Center Orientations

Please register to attend program orientations. Once you register you will be contacted and registered to attend the next scheduled orientation.

CLICK HERE TO REGISTER ONLINE TODAY

One on One Business Coaching

If you need counsel from professionals that understand what it takes to start a business or how to succeed as a business, you have come to the right place. Our staff of seasoned professionals will be glad to help research and answer your business resource questions. Best of all, there is no fee for our counseling service.

To set up an appointment simply call The Entrepreneurship Center (TEC) info line at 404-969-5572 and leave a message.

OR

CLICK HERE FOR ONLINE COACHING REQUEST FORM

Small Business Development Workshop Series

LEVEL I - Start-up Essentials for Entrepreneurs

LEVEL II - Mapping Your Success: Your Business Plan

SPECIAL EVENTS - Managing Your Business for Profit and Growth: Lessons Learned on the Way to the Top

To learn more about the program and how you may qualify for a scholarship, click on the registration link below to register with our program. Once your information has been received you will be contacted to attend the next scheduled orientation. Please call the TEC Info Line at 404.969.5572 if you have any questions.

For more business resources visit www.aultec.org

CLICK HERE TO REGISTER ONLINE TODAY

Founded by the National Urban League * Business Roundtable * Stonehenge Capital LLC

* Small Business Administration * Urban League of Greater Cleveland

Welcome to the Atlanta Entrepreneurship Center

The Entrepreneurship Center (TEC) works with private, public and nonprofit resources to build strong, sustainable and successful minority businesses. The result will be wealth creation, job creation and better economic health in the minority and urban core communities of Atlanta.

What does the The Entrepreneurship Center do?

The Entrepreneurship Center assesses the needs and capabilities of minority business owners in the Atlanta area. Then those aspiring or current business owners are linked with resources, classes, training and counseling that will help them grow to the next level of success. Each person contacting the TEC will receive an initial assessment of their needs. Then they will be matched to the appropriate resource or service that meets those needs.

Who sponsors it?

The AUL Entrepreneurship Center is part of a national program that represents a partnership between the National Urban League, the Atlanta Urban League and Stonehenge Community Development, LLC which is a subsidiary of Stonehenge Capital Company created to provide flexible forms of debt, equity and mezzanine financing to businesses located in low-income communities nationwide. In addition, the Georgia Pacific Foundation has also provided support for the program.

How can I get assistance with my business?

Simply contact the Atlanta Urban League through our Hotline number, 404-659-1150 or through our online Resource Navigator.

What kind of services are offered?

Many resources are available in the Atlanta area to help start or expand businesses. The list below highlights the most frequently requested services:

Business planning

Financial resources and assistance

Franchising

Legal services

Libraries and research organizations

Management issues and training

Manufacturing, high tech and life sciences development

Marketing

Networking

Nonprofit development

Office, laboratory and meeting space

Product development

Regulatory compliance

Selling to the government and large corporations

Tax services

Technical assistance

How much do services cost?

Counseling is free of charge. There may be fees for training classes, seminars etc.

Membership has it's advantages. Urban League Members may attend select classes free of charge, and realize substantial discounts on various seminars.

Do I have to meet a certain set of standards to get help?

Our program is designed to address a wide range of clients -- from current business owners, to those that are contemplating starting their own business. No matter where you find yourself in the process The Entrepreneurship Center can help.

Latest News from the Region

America's Recovery Capital Loan Program from the SBA is a no interest loan to cover debt payments.

Posted on 5/27/2009

News from Entrepreneur.com

Why Your IP Address May Soon Be Antique

Cybercrooks Tire of Windows -- They're After Your iPhone Now

How To Optimize Your Website for Local Search

Is Your Busyness Your Fault?

The Five Things You Must Do Before Approaching Any Investor

The Entrepreneurship Center Founders

© 2004 - 2011 U.S.SourceLink | Home | Site Map | Contact Us | | Print this page

Upcoming Events

No events available.

Entrepreneurship Center Orientations

Please register to attend program orientations. Once you register you will be contacted and registered to attend the next scheduled orientation.

CLICK HERE TO REGISTER ONLINE TODAY

One on One Business Coaching

If you need counsel from professionals that understand what it takes to start a business or how to succeed as a business, you have come to the right place. Our staff of seasoned professionals will be glad to help research and answer your business resource questions. Best of all, there is no fee for our counseling service.

To set up an appointment simply call The Entrepreneurship Center (TEC) info line at 404-969-5572 and leave a message.

OR

CLICK HERE FOR ONLINE COACHING REQUEST FORM

Small Business Development Workshop Series

LEVEL I - Start-up Essentials for Entrepreneurs

LEVEL II - Mapping Your Success: Your Business Plan

SPECIAL EVENTS - Managing Your Business for Profit and Growth: Lessons Learned on the Way to the Top

To learn more about the program and how you may qualify for a scholarship, click on the registration link below to register with our program. Once your information has been received you will be contacted to attend the next scheduled orientation. Please call the TEC Info Line at 404.969.5572 if you have any questions.

For more business resources visit www.aultec.org

CLICK HERE TO REGISTER ONLINE TODAY

Founded by the National Urban League * Business Roundtable * Stonehenge Capital LLC

* Small Business Administration * Urban League of Greater Cleveland

Welcome to the Atlanta Entrepreneurship Center

The Entrepreneurship Center (TEC) works with private, public and nonprofit resources to build strong, sustainable and successful minority businesses. The result will be wealth creation, job creation and better economic health in the minority and urban core communities of Atlanta.

What does the The Entrepreneurship Center do?

The Entrepreneurship Center assesses the needs and capabilities of minority business owners in the Atlanta area. Then those aspiring or current business owners are linked with resources, classes, training and counseling that will help them grow to the next level of success. Each person contacting the TEC will receive an initial assessment of their needs. Then they will be matched to the appropriate resource or service that meets those needs.

Who sponsors it?

The AUL Entrepreneurship Center is part of a national program that represents a partnership between the National Urban League, the Atlanta Urban League and Stonehenge Community Development, LLC which is a subsidiary of Stonehenge Capital Company created to provide flexible forms of debt, equity and mezzanine financing to businesses located in low-income communities nationwide. In addition, the Georgia Pacific Foundation has also provided support for the program.

How can I get assistance with my business?

Simply contact the Atlanta Urban League through our Hotline number, 404-659-1150 or through our online Resource Navigator.

What kind of services are offered?

Many resources are available in the Atlanta area to help start or expand businesses. The list below highlights the most frequently requested services:

Business planning

Financial resources and assistance

Franchising

Legal services

Libraries and research organizations

Management issues and training

Manufacturing, high tech and life sciences development

Marketing

Networking

Nonprofit development

Office, laboratory and meeting space

Product development

Regulatory compliance

Selling to the government and large corporations

Tax services

Technical assistance

How much do services cost?

Counseling is free of charge. There may be fees for training classes, seminars etc.

Membership has it's advantages. Urban League Members may attend select classes free of charge, and realize substantial discounts on various seminars.

Do I have to meet a certain set of standards to get help?

Our program is designed to address a wide range of clients -- from current business owners, to those that are contemplating starting their own business. No matter where you find yourself in the process The Entrepreneurship Center can help.

Latest News from the Region

America's Recovery Capital Loan Program from the SBA is a no interest loan to cover debt payments.

Posted on 5/27/2009

News from Entrepreneur.com

Why Your IP Address May Soon Be Antique

Cybercrooks Tire of Windows -- They're After Your iPhone Now

How To Optimize Your Website for Local Search

Is Your Busyness Your Fault?

The Five Things You Must Do Before Approaching Any Investor

The Entrepreneurship Center Founders

© 2004 - 2011 U.S.SourceLink | Home | Site Map | Contact Us | | Print this page

GIG, Inc. Photo Gallery

Friday, January 21, 2011

|

| BEFORE |

|

| AFTER |

|

| BEFORE |

|

| AFTER |

|

| BEFORE |

|

| AFTER |

|

| AFTER |

|

| BEFORE |

|

| AFTER |

|

| BEFORE |

|

| AFTER |

|

| BEFORE |

|

| AFTER |

|

| BEFORE |

|

| AFTER |

|

| BEFORE |

|

| AFTER |

|

| BEFORE |

|

| AFTER |

|

| BEFORE |

|

| AFTER |

|

| AFTER |

|

| BEFORE |

|

| AFTER |

|

| AFTER |

Subscribe to:

Comments (Atom)